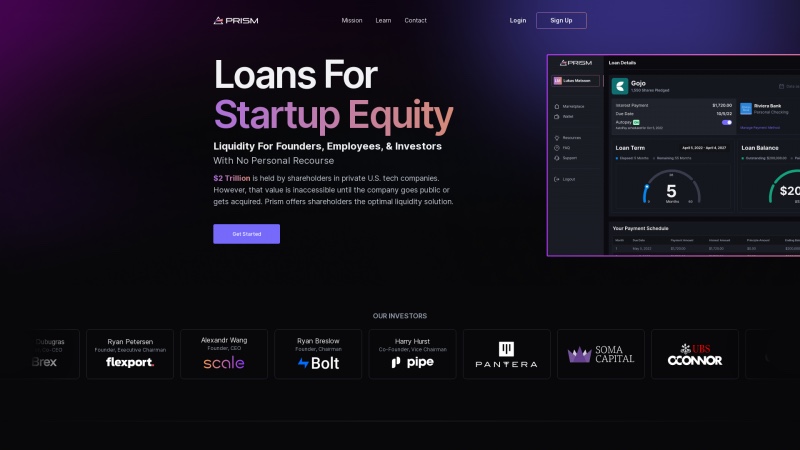

Unlock Startup Equity: Get Loans with No Personal Recourse from Prism

Category: FinanceUnlock the value of your startup equity with Prism's innovative liquidity solutions. Get quick loan offers secured by shares, saving millions compared to selling.

About prism

Prism is revolutionizing the way startup equity is accessed and utilized, providing a much-needed liquidity solution for founders, employees, and investors alike. With an impressive $2 trillion held by shareholders in private U.S. tech companies, Prism addresses a critical gap in the market by offering loans secured by startup shares, allowing individuals to unlock the value of their equity without the need to sell.

The platform's straightforward approach ensures that users can receive offers for their verified shares in mere minutes, making it an efficient option for those in need of immediate liquidity. The financial benefits of borrowing versus selling are clearly illustrated, showcasing significant potential savings. For instance, a borrower could save over $2 million compared to liquidating shares, highlighting Prism's value proposition.

Prism's marketplace model connects borrowers with a wide array of lenders, ensuring competitive terms and rates. The absence of personal guarantees and equity fees further enhances the appeal of their loans, making it a more attractive option than traditional personal credit or other private lenders.

Moreover, Prism's commitment to enhancing employee satisfaction and retention through liquidity options is commendable. By providing employees with the ability to access funds while maintaining their equity, companies can foster a more engaged and motivated workforce.

Prism stands out as a forward-thinking solution for those looking to leverage their startup equity. Its user-friendly platform, combined with a strong understanding of the needs of modern employees and investors, positions it as a leader in the financial technology space. For anyone involved in the startup ecosystem, Prism is undoubtedly a game-changer worth considering.

List of prism features

- Liquidity for founders

- employees

- & investors

- Loan secured by startup shares

- Instant offers for verified shares

- Comparison of borrowing vs. selling

- Access to funds in as little as 3 days

- Market connection between borrowers & lenders

- No personal guarantee required

- Maximum loan amount up to $100 million

- No equity fees

- Maintain custody of shares

- Immediate liquidity options

Leave a review

User Reviews of prism

No reviews yet.