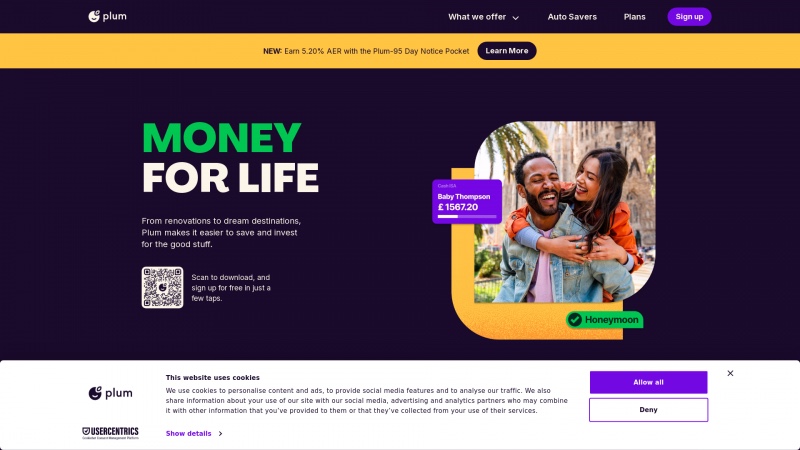

Discover Plum, the top UK personal finance app of 2023. Effortlessly save, invest, and budget with smart automation. Join over 2 million satisfied users today!

About withplum

Plum is an exceptional financial app that truly empowers users to take control of their money. With over 2 million satisfied customers, it stands out as the best UK personal finance app of 2023, and for good reason. The platform offers a seamless experience for saving, investing, and budgeting, all through smart automation.

One of the most impressive features of Plum is its ability to help users save effortlessly. With eight automatic saving rules, users can set aside money consistently without even noticing it. This is particularly beneficial for those who struggle with traditional saving methods. The app also provides a variety of investment options, allowing users to build a diversified portfolio tailored to their risk preferences.

The user-friendly interface makes navigating through the app a breeze, and the integration with all major UK banks ensures that managing finances is straightforward and efficient. The Plum debit card further enhances the budgeting experience, allowing users to keep their spending in check.

Moreover, Plum's commitment to security is commendable. With advanced encryption and support for biometric authentication, users can rest assured that their financial data is safe. The customer support team is readily available to assist with any inquiries, making the overall experience even more reassuring.

Plum is not just a financial app; it's a comprehensive tool that helps users achieve their financial goals with ease. Whether you're looking to save for a holiday, invest for the future, or simply manage your spending better, Plum is the perfect solution. Downloading the app is a step towards smarter financial management, and I highly recommend it to anyone looking to enhance their financial well-being.

List of withplum features

- Auto Savers Plans

- Easy Access Account

- Plum Interest

- Cash ISA

- 95-Day Notice Account

- Stocks and Shares ISA

- Self-Invested Personal Pension

- Plum Brain

- Security features (face/fingerprint ID)

- Support available 7 days a week

- Multiple pricing plans

- Free trial for paid plans

- Savings calculator

- FAQ section

- Mobile app availability

Leave a review

User Reviews of withplum

No reviews yet.