Smarter Identity Verification and KYC Solutions for High-Growth Businesses

Category: TechnologyDiscover Cognito's identity verification and KYC solutions designed to enhance customer onboarding. Experience fast, secure, and compliant processes tailored for your business.

About blockscore

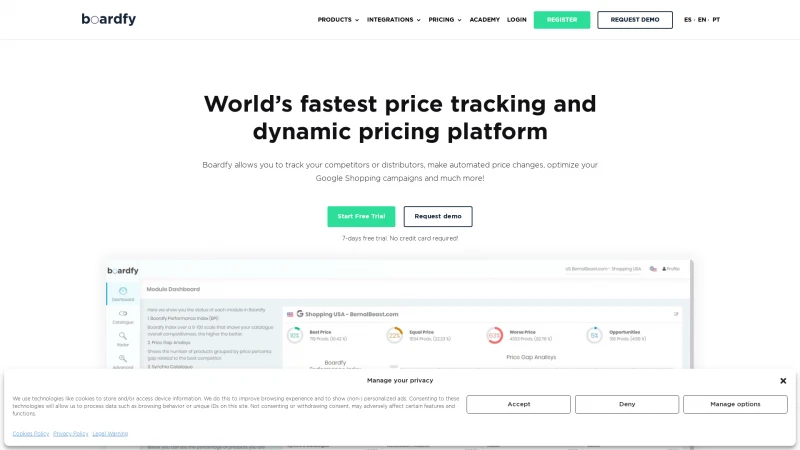

Cognito's homepage presents a comprehensive and user-friendly overview of their identity verification and KYC solutions, making it an invaluable resource for businesses seeking to enhance their customer onboarding processes. The layout is intuitive, allowing users to easily navigate through various products and services, including their all-in-one ID verification, phone-based IDV, and AML compliance solutions.

One of the standout features is the emphasis on conversion optimization. Cognito's Flow product is designed to streamline the onboarding experience, boasting an impressive average completion time of under 60 seconds and high pass rates for both US and international users. This focus on efficiency not only enhances user experience but also significantly reduces friction during the verification process.

Moreover, Cognito's commitment to security and compliance is evident through their robust screening capabilities, which include daily watchlist re-scans and advanced algorithms to minimize false positives. This ensures that businesses can maintain compliance with AML and PEP regulations while effectively managing risk.

The developer-centric approach is another highlight, with extensive API documentation and support that cater to various integration needs. Whether businesses prefer a no-code solution or a fully integrated system, Cognito provides flexible options that can be tailored to specific requirements.

Overall, Cognito stands out as a leader in the identity verification space, offering innovative solutions that not only meet compliance standards but also drive business growth. Their dedication to continuous improvement and adaptation to regulatory changes further solidifies their position as a trusted partner for high-growth businesses.

List of blockscore features

- Identity verification

- KYC compliance

- Business onboarding

- AML compliance

- Watchlist screening

- Fraud detection

- Phone-based ID verification

- Document verification

- Selfie verification

- Multi-user reviews

- API integration

- No-code solutions

- Hybrid verification

- Full integration

- Daily watchlist re-scans

- Smart auto-assignment

- Compliance CRM

- Extensive API documentation

- Sandbox exploration

- Continuous feature updates

Leave a review

User Reviews of blockscore

No reviews yet.